IMF Survey Magazine: Countries & Regions

ASIA'S PROSPECTS

Emerging Markets Face Tough Climb Back to Past Growth Levels

June 12, 2014

- Structural factors weigh on emerging market growth

- External environment less supportive, but impact varies by country

- Countries need to rethink growth engines, focus on structural reforms

As the global environment turns less supportive and productivity gains of the last decade fade, growth in emerging markets will have to come from new engines, supported by a new wave of structural reforms, a new IMF study says.

Emerging Markets in Transition: Growth Prospects and Challenges sheds light on the factors behind last decade’s strong performance in emerging economies and how the ongoing global transitions will affect their prospects going forward. It builds on the April 2014 World Economic Outlook that looked at the role of external and domestic drivers of growth in emerging economies and the discussions that took place during last fall’s conference on the same topic.

The study observes that, despite the changing external environment, sustained growth in these countries is still possible. But emerging markets need to maintain sound domestic policies, place renewed emphasis on structural reforms, and strive to increase productivity.

“Rebounding from the current slowdown and reclaiming the higher growth of the last decade will not be easy,” the authors note. “Early and decisive commitment to tailored reforms will have significant benefits over the longer term.”

The 2000s: A favorable global context, with uneven impact

A confluence of favorable external conditions supported emerging market growth in the 2000s. Growing global demand and expanding supply chains boosted global trade, while lower interest rates in advanced economies eased global financial conditions. The commodity price “supercycle” supported growth in many commodity-exporting emerging and developing countries. And increased trade and financial openness allowed emerging markets to take advantage of these conditions.

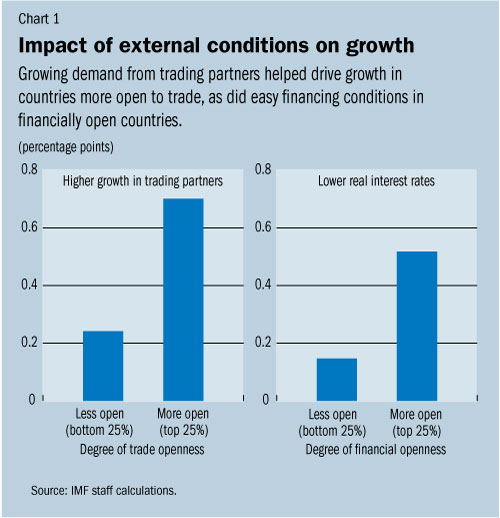

However, the benefits from favorable external conditions differed substantially across emerging markets. Growing demand from trading partners added on average half a percentage point to growth in countries that were more open to trade. Easy financing conditions boosted investment and added on average over a third of a percentage point to growth in financially open countries, while high commodity prices supported higher investment and growth in the more commodity-dependent economies (Chart 1).

Many emerging markets also took advantage of the “good times” to strengthen policy frameworks, reduce vulnerabilities, and build policy space. These countries were able to bring down debt, enjoy lower borrowing costs, and adopt more flexible exchange rate regimes that proved crucial when the global financial crisis hit.

For most emerging economies, higher growth during the 2000s was manifested on the domestic side in increased total factor productivity. An important part of this productivity boom reflected countries moving up the value chain and reallocating factors to higher-productivity sectors. Gains from reforms of earlier decades that increased trade and financial liberalization added to productivity growth and favorable external conditions facilitated the transition.

Recent slowdown and rebound (halfway)

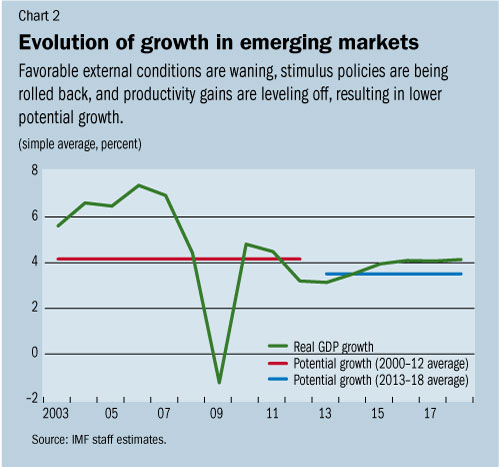

Now that the favorable external conditions of the 2000s are waning, stimulus policies enacted in response to the Great Recession are being rolled back, and productivity gains are leveling off, economic growth has been slowing across emerging markets. While these factors matter to varying degrees—the drivers of strong growth differed across emerging markets—the slowdown has been widespread and persistent. In fact, 80 percent of emerging markets decelerated in 2012, and by end-2013, emerging market growth was on average 1½ percentage points lower than in 2010-11.

The study’s estimates confirm that the widespread nature of the slowdown reflected weaker external demand, particularly from advanced economies and China. On the domestic front, a number of emerging markets rolled back fiscal stimulus that was put in place in response to the global financial crisis, and that played a role in lowering growth.

But how persistent is the slowdown? Both cyclical and structural factors have been weighing on growth to different degrees, the study reveals, and on average, they are equally important in explaining the slowdown (Chart 2).

Future growth challenges

What do these findings imply for emerging market growth prospects in the coming years?

Since part of the recent slowdown in emerging markets reflected cyclical and external factors, as demand from advanced economies strengthens, so should growth in emerging markets.

At the same time, the global context is changing to a less supportive one. Advanced economies are not expected to return to the debt-fueled, pre-crisis growth rates. As advanced economies exit from unconventional monetary policies at different speeds, emerging markets are likely to see more volatility and higher borrowing costs. Commodity prices are not expected to be as buoyant going forward, which may dampen investment in commodity-exporting countries

The domestic context for emerging markets is also changing. Growth is projected to naturally slow to some extent as economies converge to higher income levels. In some countries, particularly those that have relied excessively on consumption, structural impediments are becoming binding, while in others efforts to further expand employment will hit natural limits. Moreover, countries that have allowed external and financial imbalances to build since the crisis may see growth slow further as they address risks to their balance sheets.

Near-term policies can help mitigate the effects of the changing external environment. For example, growth in commodity-exporting economies would be less sensitive to declines in terms of trade if these countries saved a greater share of the commodity windfall. Similarly, flexible exchange rates can mitigate the effects of external financial shocks on growth. That said, beyond the cyclical recovery, attaining the high growth rates of the last decade going forward will require concerted policy efforts.

Recalibrating policy priorities

With the prospect of a less-supportive external environment, emerging market growth engines of the last decade will need to be reoriented to sustainable domestic sources, the study says. This means implementing structural reforms to reorient growth—away from consumption in some cases (e.g., Brazil and Turkey) and away from investment in other cases (e.g., China). Strengthening resilience to external shocks will require addressing increasing domestic vulnerabilities and containing the buildup of private sector excesses.

Tailored structural reforms are also needed to improve factor allocation and boost productivity. For lower-income countries, reforms that help develop new sectors and facilitate a move up the value chain would have larger gains. For higher-income countries, investing in research and development, higher education, and technological development would be priorities.

Managing the transition will pose a considerable challenge, the authors note. Structural reforms are costly, not always popular, and often opposed by strong vested interests.

Nonetheless, concerted policy action is needed now, the study says. The civil unrest and political tensions seen in a number of large emerging markets over the recent years reflects the population’s growing frustrations with dimming growth prospects, coupled with high (or increasing) income inequality. Policymakers need to develop and clearly communicate their longer-term strategies to the public to garner the needed support for fundamental change, while making sure that the gains from growth are more evenly shared. This requires protecting the more vulnerable groups from the transition costs of these reforms.