|

Commonwealth of Independent States: A Rebalancing of Growth Is Needed to

Sustain the Expansion

Real GDP growth slowed significantly in the Commonwealth of Independent

States (CIS) during 2005, to 6.5 percent from 8.4 percent in 2004 (see table

below). A particularly sharp slowdown in Ukraine accounted for much of this,

although

the pace of expansion also moderated in other key countries in the region.

Lower output growth in the energy sector (Russia, Kazakhstan), political and

economic uncertainties that undermined investment (Ukraine, Kyrgyz

Republic), and an increasingly negative contribution from the external

sector (Ukraine, Russia) all contributed to this weaker growth.

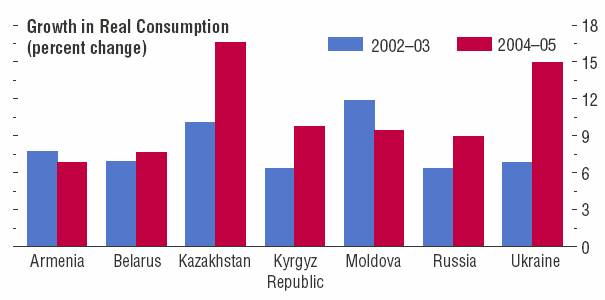

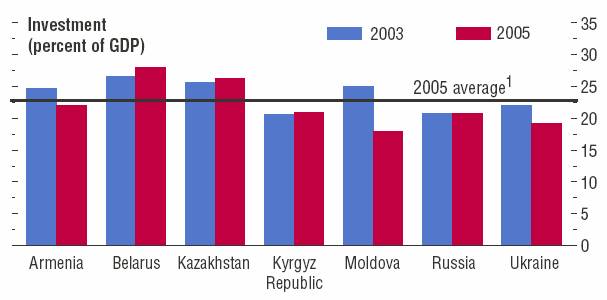

At the same time as growth has slowed, the composition of demand has been

very unbalanced, raising concerns about the sustainability of growth going

forward. Investment has remained weak, averaging just under 21 percent of

GDP in 2005, the lowest of any emerging market and developing country region

(see charts below). Consumption, on the other

hand, has expanded strongly, particularly in Russia, Ukraine, and

Kazakhstan, underpinned by large hikes in wages and public pensions and

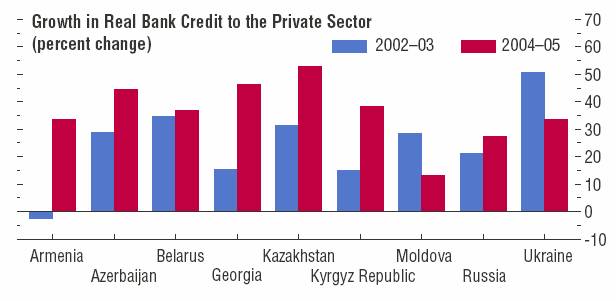

increased access to credit. Indeed, credit has grown extremely strongly in a

number of countries in the region, and in Ukraine and Kazakhstan has

increasingly been directed at households and a significant share is

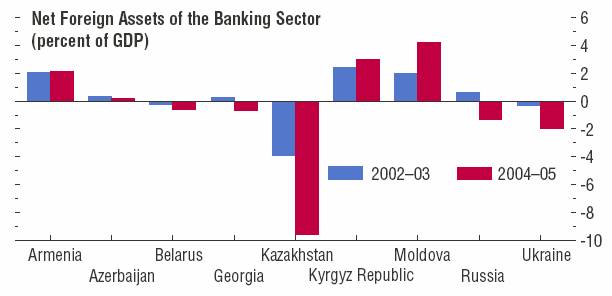

denominated in foreign currency. While the ongoing process of financial

deepening in the region is welcome—the ratio of bank credit-to-GDP is still

low in many countries—rapid credit growth poses a risk to financial

stability given banks’ generally weak abilities to assess borrower

creditworthiness and the increasing reliance by banks in some countries on

financing from abroad.

This combination of strong consumption growth and weak investment has led to

increasing capacity constraints in some countries and sectors and, together

with higher food and energy prices (although pass-through to domestic prices

has not been complete), contributed to a sharp increase in inflationary

pressures in the first half of 2005 that have moderated only slightly in

recent months. The current account, however, remains in large surplus at the

regional level, although there is increasing differentiation across

countries. In energy exporters as a group, higher oil prices underpinned a

further increase in the surplus during 2005, but in energyimporting

countries the surplus declined due both to higher oil imports and an

increase in non-oil import volumes.

Looking forward, growth is projected to slow further to 6 percent in 2006,

although decisive policy actions will be needed to lock in this pace of

expansion. Monetary policy will increasingly need to focus on reducing or

containing inflation, with the authorities correspondingly allowing nominal

exchange rates to appreciate as necessary. And while countries that are

benefiting from higher oil revenues have scope to raise productive

government spending, such increases will need to be carefully managed in

line with cyclical considerations to ensure they are consistent with overall

macroeconomic policy objectives.

To encourage investment spending, a more hospitable business climate needs

to be created by reducing uncertainties about government intervention in the

economy and moving to strengthen the institutional structures necessary for

vibrant market-based economies to flourish.

Structural reforms are also needed to boost productivity in the noncommodity

sectors to improve competitiveness in the face of upward pressures on

exchange rates. In terms of the financial sector, progress has been made in

banking reform, but it has lagged that in countries in central and eastern

Europe. Regulatory and supervisory systems, in particular, need to be

upgraded in line with the growing importance of the financial sector.

Turning to individual countries, after a weak start to 2005, real GDP growth

in Russia has accelerated, and the economy is expected to expand by 6

percent in 2006 (0.8 percentage points higher than projected in the

September 2005

World Economic Outlook).

The expansion is being driven by private consumption, while export growth

has fallen. Investment, despite a recent pickup, is relatively subdued, and

concerns remain that the economy may begin to run into capacity constraints.

Real wages are rising faster than productivity, imports are surging, and CPI

inflation is running at over 11 percent.

Against this background, fiscal policy should not be relaxed until cyclical

pressures have eased, and monetary policy needs to be tightened.

Without allowing for greater nominal exchange rate appreciation, it is

unlikely the central bank will be able to meet its end-2006 inflation target

of 8.5 percent. Turning to the financial sector, credit growth remains

rapid, and it is important that prudential practices are strengthened under

the new deposit insurance scheme to ensure that risks in the sector are

appropriately managed.

In Ukraine, real GDP growth has slowed sharply, reflecting a less favorable

external environment and political and policy uncertainties that have

undermined investment.

Growth is expected to slow further this year— to 2.3 percent—as continued

political uncertainties and a significant hike in import prices for natural

gas weigh on activity. Inflation has fallen from a peak of 15 percent in

mid-2005, but remains over 10 percent, while credit growth remains strong.

Reflecting uncertainties about the economic and political situation, spreads

on Ukrainian external bonds have widened somewhat and the central bank

conducted substantial foreign exchange interventions to maintain the

official hryvina-U.S. dollar exchange rate. The authorities need to tighten

monetary policy to reduce inflation, support this with fiscal restraint, and

implement reforms to create a positive investment climate. In Kazakhstan,

growth remains strong, underpinned by high oil prices. Inflationary

pressures, however, have risen, and the central bank has raised interest

rates, although further tightening is still required. WTO accession

negotiations are proceeding, but progress with other structural reforms has

been slow.

Growth in the low-income CIS countries remains very strong, although there

are considerable differences across countries. In Azerbaijan (oil

production), Armenia (remittance inflows and a good harvest), and Georgia

(agricultural recovery), growth has picked up, but in the Kyrgyz Republic

and Tajikistan it has slowed. The central challenge for the region remains

to put in place the policies that will maintain the strong growth needed to

reduce poverty going forward. To achieve this, the

sources of growth need to be diversified, particularly by improving the

business climate to encourage investment in the noncommodity sectors,

liberalizing trade regimes, and reducing high external debt levels.

Charts:

Commonwealth of Independent States:Unbalanced Growth Raises Concerns

About the Outlook

Consumption has grown strongly in a number of countries, supported by wage

and pension increases and rapid credit growth.

Investment, however, remains relatively weak,

raising concerns about the sustainability of current growth rates.

Sources: IMF,

International Financial Statistics;

and IMF staff calculations.

1/ Emerging market and developing countries

excluding China. |