CAPITAL MARKET WEEKLY

No. 47 (211) - 21 November 2007

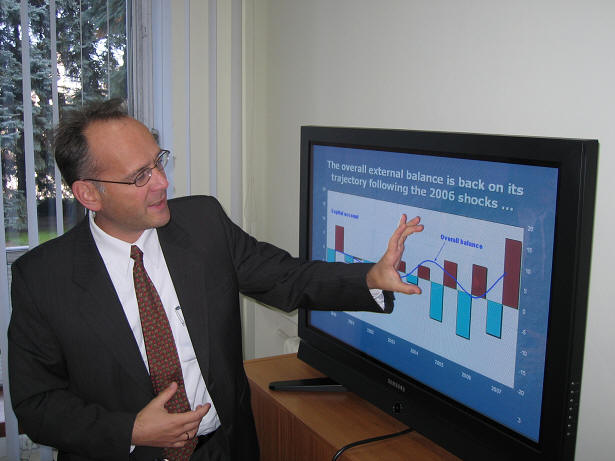

THE ECONOMIC SITUATION IN MOLDOVA IS MUCH BETTER THAN PROJECTED, says

IMF Resident Representative in our country

The economic situation in Moldova is much better

as compared to initial projections.

For example, the economic growth for the first six months of the year

amounted to 8 percent as according to our projections we expected 6

percent growth of GDP, sated this Monday the Resident Representative of

the International Monetary Fund in the Republic of Moldova Johan

Mathisen.

The IMF expected 5 percent growth of GDP in the Republic of Moldova

this year. In particular, the Resident Representative of the IMF in the

Republic of Moldova ascertained that “growth of investments and exports

is much higher as compared to projections made by the IMF”.

This year the size of foreign investments in Moldova will reach the

figure of USD 450 million alongside with an increase of domestic

investments, added Johan Mathisen.

According to Johan Mathisen, the current level of investments in the

Republic of Moldova reminds one on the level of such in the countries of

Central Europe prior to joining the European Union.

The external imbalance returned to its initial trajectory under the

sign of plus after overcoming external shocks experienced in 2006.

Pressure of current account continues to remain moderate despite of the

increase of trade deficit, fully compensated by the growing inflow of

capital. The level of accumulation of foreign assets has increased as

well.

To that end, the IMF Resident Representative in Moldova appreciated

the accumulation of substantial international reserves by the National

Bank of Moldova which exceeded USD 1.2 billion. At the same time, Johan

Mathisen voiced his concerns about the escalation of inflation, which

“causes growing concerns”. According to the data made available by the

National Bureau of Statistics, for the ten months of this year the

aggregate growth of inflation has reached the figure of 10.7 percent;

however this “is not the reason for suspending financing”.

Likewise, the Resident Representative of the International Monetary

Fund in the Republic of Moldova notified that arriving to Chisinau for

the period of 7 through 21 December will be the IMF mission with the

scope of evaluating performances under the Memorandum of Economic and

Financial Policy and negotiating on the new Memorandum.

Johan Mathisen concluded by stating that the main conditions

stipulated by the Memorandum were fulfilled.

“The government is now at the last stage of working out new

Memorandum”, said the resident representative of the IMF in the Republic

of Moldova. Criteria for reporting will be set for the March of 2008 as

well as for the end of this year when the assessment mission will arrive

to Chisinau. Privatization of Banca de Economii shall become a separate

issue of discussion conducted by the mission of the International

Monetary Fund and Government of the Republic of Moldova, stated Johan

Mathisen, IMF Resident Representative in Moldova during the ordinary

meeting of the Club of Economic Press.

According to the Memorandum on the Economic and Financial Policy,

evaluation of Banca de Economii was due to be accomplished in 2007;

however, after company Deloytte & Touche – the winner of the tender for

evaluation of Banca de Economii manifested some interest to act as an

intermediary in the process of bank privatization, the process of

privatization was suspended while the agreement with the company was

cancelled.

“We will discuss the available possibilities” stated to the press

Johan Mathisen. While urging the authorities to make consistent efforts

in the respective direction, the International Monetary Fund does not

hasten Chisinau. The practice shows that “when the conditions set are

very rigid, then irrespective of the situation, the outcome could be

unsatisfactory”; it is important that the privatization “is conducted

well and correct”, added Johan Mathisen.

The representatives of the International Monetary Fund said before

that it would be advisable to sell out Banca de Economii to a reputable

foreign bank that could bring in new technologies and increase its

capital.

(Translation)

Source

Photo: BBC, Marin Turea |