|

Limba romana

Hotels,

Restaurants, and Cafes (HORECA) –

Trends and Policy Considerations

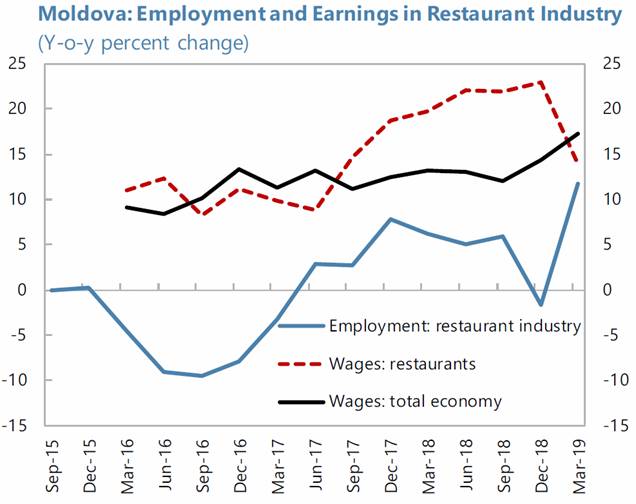

Moldova’s HORECA industry is growing but remains

relatively underdeveloped. It accounts for about 1 percent of formal

employment (of which about 80 percent is in restaurants), much smaller than in

Romania where it accounts for about 4 percent. Within the industry, the

restaurant sector is experiencing an expansion, with annual employment growth

averaging about 4.5 percent in 2017–19, underpinned by robust domestic demand.

Moreover, average wage in the sector has grown by almost a half since 2016,

outpacing economy-wide wage growth by 20 percentage points. The sector’s average

wage reached about 70 percent of the economy- wide level, compared to 60 percent

ratio in Romania.

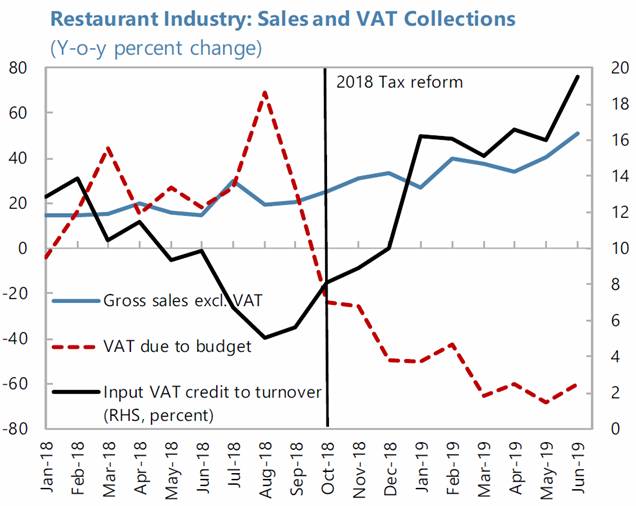

The October 2018 tax changes have not produced expected

outcomes. Undertaken with a view to primarily de-shadow the economy, the VAT

rate applicable to HORECA industries was halved to 10 percent from the standard

rate. The industry also benefitted from the economy-wide PIT and SSC rates cuts.

Nonetheless, the wage-related tax policy measures did not lead to a material

de-shadowing of labor in the industry. Specifically, growth of the Health Fund

contributions—unaffected by policy changes—indicates no level or trend shift in

the tax base. Moreover, de-shadowing of sales has not paid off considering VAT

revenue loss. Post-reform weighted average VAT rate on sales declined from about

19 to 13 percent, while average VAT rate on inputs remained at about 19 percent.

Despite a strong growth of sales, VAT due to the budget has dropped by 60

percent, while the stock of VAT input tax credit has surged from the average of

about 5 percent of turnover to almost 20 percent. For businesses that operate

under relatively thin margins, g a large stock of tax credits is costly in terms

of profitability and can also encourage the rise of informality.

GRAFIC:

Industria restaurantelor: vânzări și TVA colectat

(modificarea anuală, %)

Source: IMF Staff Report -

Republic of Moldova: Fourth

and Fifth Reviews Under the Extended Credit Facility and Extended Fund Facility

Arrangements, Completion of the Inflation Consultation, and Request for

Extension of the Arrangements and Rephasing of Access

|